In the realm of economic indicators, Consumer Price Index (CPI) holds a paramount position. It serves as a barometer, reflecting the fluctuations in prices of goods and services within a specific region. In the context of the Eurozone, CPI plays a crucial role in assessing the health of its economy and guiding monetary policy decisions. This article delves into the intricacies of Eurozone CPI, shedding light on its significance, trends, and implications, with a focus on Eurozone Dubai.

The Significance of CPI in the Eurozone

CPI serves as a vital gauge of inflation within the Eurozone, which comprises 19 member states sharing the euro currency. As a measure of the average change over time in the prices paid by consumers for a basket of goods and services, CPI reflects the purchasing power of consumers and the overall cost of living. Central banks, including the European Central Bank (ECB), closely monitor CPI to formulate monetary policies aimed at maintaining price stability and sustainable economic growth.

Components of Eurozone CPI

Eurozone CPI encompasses a diverse range of goods and services, categorized into various sectors such as housing, transportation, food, and energy. Each component carries a different weight in the overall index, reflecting its significance in consumer spending patterns. Housing, for instance, typically holds a substantial weight due to its recurring nature and significant impact on household budgets. Understanding the composition of Eurozone CPI enables policymakers to discern underlying inflationary pressures and devise targeted interventions accordingly.

Trends in Eurozone CPI

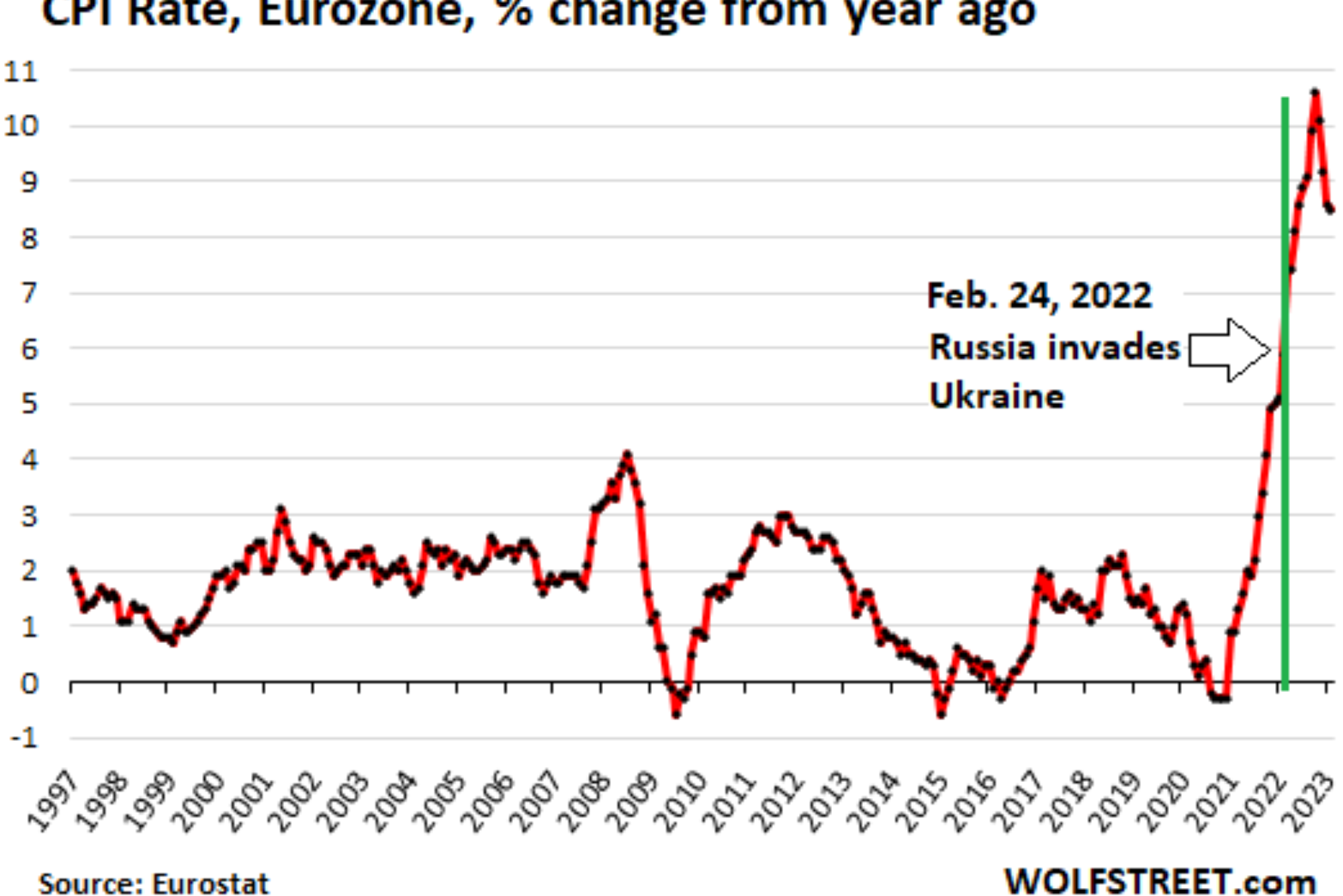

Examining the trends in Eurozone CPI unveils valuable insights into the prevailing economic conditions and future outlook. In recent years, the Eurozone has grappled with subdued inflationary pressures, prompting concerns about deflationary risks. Factors such as sluggish economic growth, tepid demand, and external shocks have contributed to this phenomenon. Despite concerted efforts by monetary authorities to stimulate inflation through accommodative measures, achieving the ECB’s target of close to but below 2% has proven elusive.

Impact of Eurozone CPI on Monetary Policy

The ECB, as the primary monetary authority for the Eurozone, closely monitors CPI dynamics in its pursuit of price stability. Deviations from the inflation target necessitate proactive policy responses aimed at reinvigorating economic activity and bolstering inflationary pressures. Conventional tools such as interest rate adjustments and unconventional measures like quantitative easing are deployed to influence borrowing costs, stimulate spending, and steer inflation towards the desired trajectory. However, the effectiveness of monetary policy in addressing structural impediments to inflation remains a subject of debate.

Eurozone Dubai: A Nexus of Global Trade and Finance

Dubai, with its strategic location and well-established infrastructure, serves as a linchpin in global trade and finance. As a key player in the Eurozone’s external trade relations, Dubai plays a pivotal role in facilitating the flow of goods, services, and capital between the Eurozone and other regions. Its status as a vibrant economic hub, characterized by robust logistics networks and business-friendly policies, enhances the Eurozone’s connectivity with emerging markets and fosters economic synergies.

Navigating Inflationary Challenges

As the Eurozone grapples with inflationary challenges, policymakers confront the daunting task of striking a delicate balance between supporting growth and safeguarding price stability. Structural reforms aimed at enhancing productivity, fostering innovation, and addressing supply-side constraints are imperative to bolstering the Eurozone’s long-term growth potential. Additionally, fostering a conducive business environment and promoting investment in sectors with high multiplier effects can stimulate economic activity and mitigate inflationary pressures.

Eurozone CPI stands as a critical barometer of inflationary pressures within the Eurozone economy, influencing monetary policy decisions and shaping the broader economic landscape. By comprehensively analyzing CPI trends and their implications, policymakers can devise informed strategies to navigate the complex challenges of price stability and sustainable growth. Against the backdrop of Eurozone Dubai‘s pivotal role in global trade and finance, fostering collaboration and harnessing synergies hold the key to unlocking the Eurozone’s full economic potential in the years ahead.